Analysts Fuel Interest with New Targets for Bloom Energy

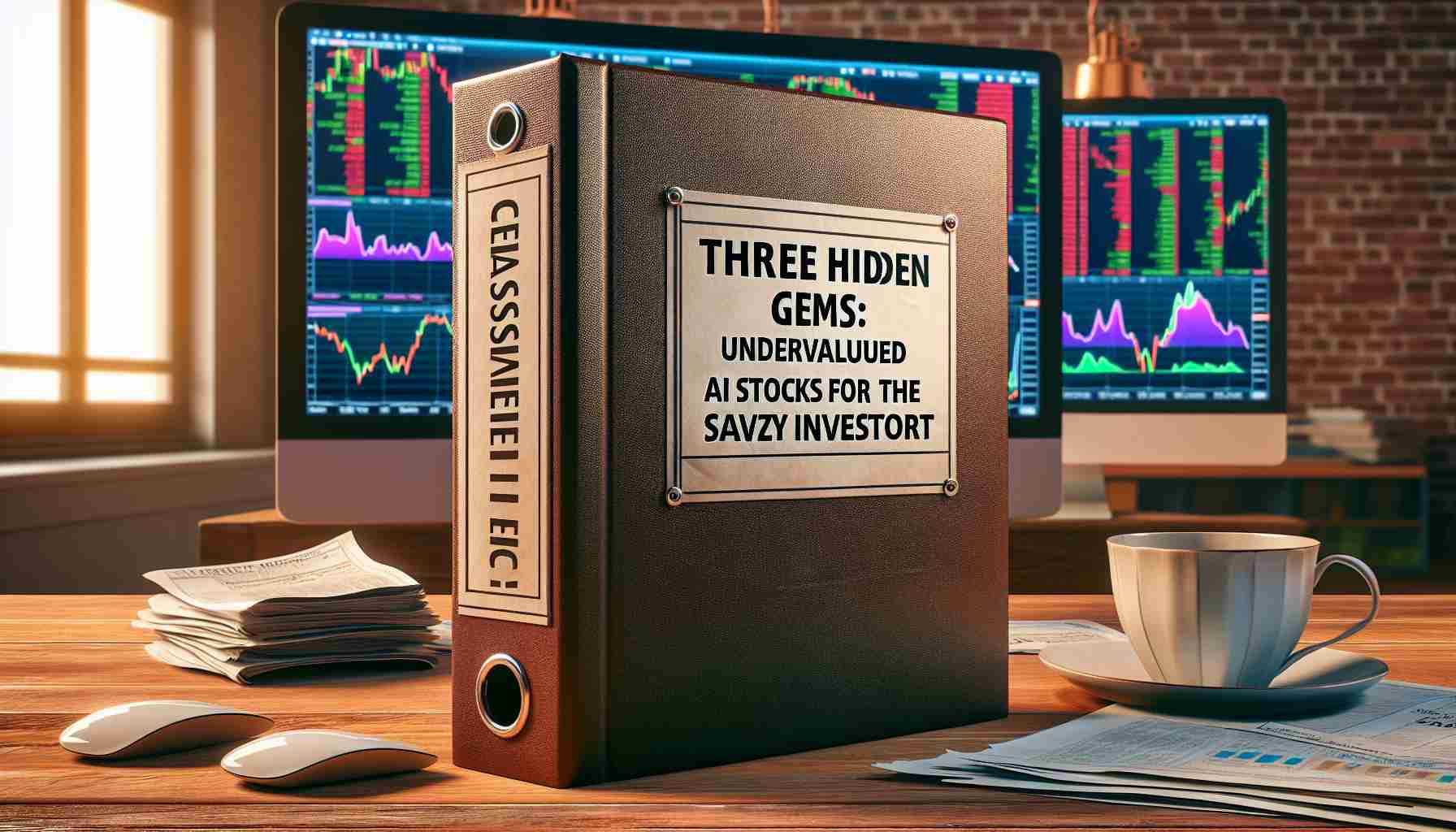

In recent developments surrounding Bloom Energy, investors received some compelling updates that could influence their decisions. Piper Sandler, a prominent research firm, has notably raised Bloom Energy’s price target from $20 to $30, adding momentum to the already growing interest in the company. Their optimistic “overweight” rating suggests a potential 19.57% upside, captivating investors’ attention.

Increased Ratings Spark Market Buzz

Several other research firms quickly followed suit. Marathon Capital upgraded their view on Bloom Energy from a “hold” to an impressive “strong-buy” recommendation. Meanwhile, Morgan Stanley adjusted their price outlook, now predicting a $28 valuation with an “overweight” rating. On the flip side, Truist Financial and Robert W. Baird took a more cautious approach, lowering their respective targets but still positioning the company favorably overall.

Bloom Energy’s Peculiar Insider Moves

Amidst these fluctuating ratings, insider trading activities at Bloom Energy have also stirred interest. Shawn Marie Soderberg, an insider, sold more than a thousand shares, gaining nearly $31,658 in the transaction. Although this signifies a minor reduction in her stake, totaling 0.76%, it adds another layer of intrigue to the company’s ongoing narrative.

Major Institutional Moves

Bloom Energy’s stock remains a hot topic among hedge funds and institutional investors. This year’s first quarter saw significant increases in holdings by Russell Investments Group, Vanguard Group Inc., and Price T Rowe Associates. Notably, hedge funds own 77.04% of the company’s stock, indicating strong institutional confidence despite some cautious analyst ratings.

Bloom Energy continues to be a company to watch, as market dynamics evolve.

A Shocking Shift for Bloom Energy: Find Out the Analysts’ Bold Moves!

The energy sector is rife with speculation, and Bloom Energy is no exception. The recent surge in analyst activities has brought the company into the limelight, but what lies beneath these market maneuvers?

Critical Questions Surrounding Bloom Energy

One crucial question is what underpins the optimistic forecasts by analysts like Piper Sandler and Morgan Stanley. Are these predictions rooted in solid company fundamentals, or merely reflections of broader market trends? Another important query is how recent insider trading activities, like those by Shawn Marie Soderberg, impact investor confidence. Are these selling decisions indicative of internal concerns, or simply routine portfolio adjustments?

Challenges and Controversies

Bloom Energy faces a few contentious issues. A primary challenge is the significant variability in analyst ratings, which can create confusion among investors. While some view this as a sign of a dynamic market, others perceive it as a signal of underlying volatility. Additionally, the environmental and regulatory challenges associated with transitioning to cleaner energy solutions present hurdles for future growth.

Advantages and Disadvantages of Current Market Moves

Advantages:

1. Increased Visibility: The rise in analyst activity brings greater visibility to Bloom Energy, potentially attracting more investors.

2. Strong Institutional Support: With hedge funds owning 77.04% of the stock, there’s evident institutional confidence, which often translates to stability.

3. Innovative Technology: Bloom Energy’s focus on hydrogen and fuel cell technology positions it well in the growing renewable energy market.

Disadvantages:

1. Market Volatility: Conflicting analyst ratings can introduce volatility, affecting shareholder confidence.

2. Insider Sales: Insider trading activities, like the recent share sale by Shawn Marie Soderberg, could be perceived negatively by the market.

3. Regulatory Risks: The transition to sustainable energy comes with regulatory uncertainties that could impact future performance.

Prospects Moving Forward

Looking ahead, Bloom Energy’s journey will depend significantly on its ability to navigate the existing challenges while capitalizing on its technological innovations. Keeping a close eye on analyst adjustments, insider activities, and market reactions will be crucial for stakeholders.

For those interested in broader trends in the energy sector, exploring reliable resources can provide deeper insights. Popular sources include Bloom Energy’s official site, which offers comprehensive information about the company’s strategic directions, and Bloomberg, known for its extensive market analysis and updates.

Bloom Energy remains a fascinating company to watch, with the potential for exciting developments in the energy landscape.