If you’re considering investing in the renewable energy sector, you may have heard of NextEra Energy. As one of the leading companies in the field, understanding what drives the success of this industry titan can provide valuable insights. But what should potential investors know before diving in?

NextEra Energy, headquartered in Juno Beach, Florida, is a prominent force in the utility industry, particularly known for its commitment to clean energy initiatives. The company operates through multiple business segments, including Florida Power & Light Company (FPL) and NextEra Energy Resources, LLC, making it a diversified enterprise in both regulated and renewable markets.

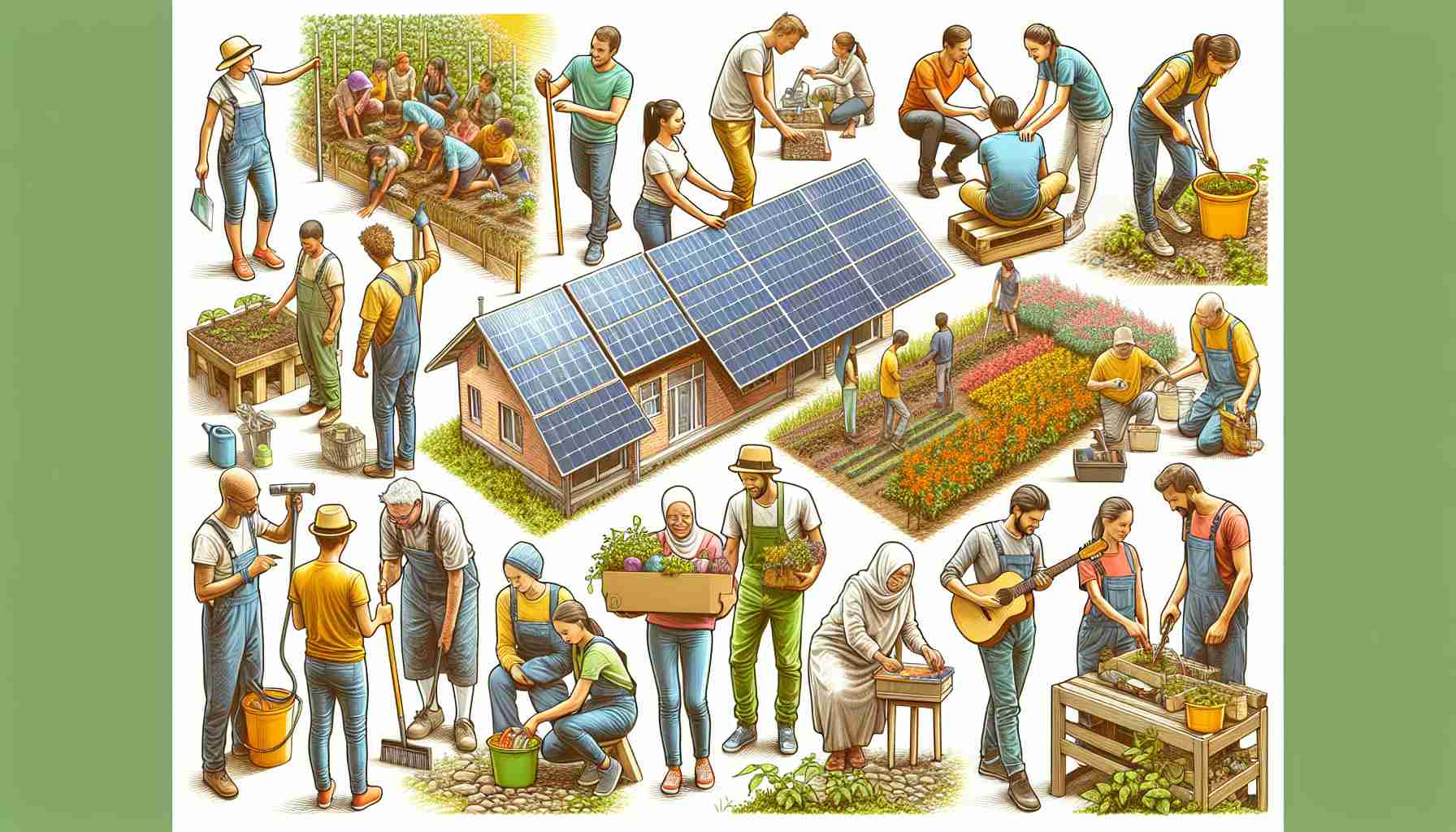

One of the key highlights for investors in NextEra is its substantial investment in renewable energy projects. It is the world’s largest generator of renewable energy from the wind and sun, positioning it as a leader in the transition to a greener grid. This focus not only enhances its sustainability profile but also offers a robust growth potential amid the global shift towards cleaner energy solutions.

NextEra’s financial performance has been notable as well. The company has seen consistent revenue growth, driven by strategic expansions and an increasing portfolio of clean energy projects. For investors, these elements underscore the potential of stable and lucrative returns.

However, it’s essential to remain mindful of the inherent risks, such as regulatory changes and fluctuating energy prices, which could impact the company’s financial health.

Ultimately, understanding these facets can help investors make informed decisions regarding NextEra Energy, ensuring alignment with both financial goals and values in promoting a sustainable future.

Secret Challenges Facing NextEra Investors

NextEra Energy, a trailblazer in the renewable energy sector, is not without its complexities and controversies. While its green energy initiatives have attracted a multitude of investors, there are unique considerations to keep in mind when evaluating this energy giant.

A factor often overlooked is the potential legal challenges NextEra might face. As with many large-scale utilities, there can be significant pushback from local communities and environmental activists regarding the impacts of sprawling renewable projects. These challenges can result in delays and additional costs, impacting investor expectations.

Furthermore, NextEra’s reliance on governmental incentives highlights another layer of complexity. The renewable energy sector often benefits from federal and state subsidies, tax incentives, and favorable regulatory conditions. However, shifts in the political landscape can change the availability and stability of these supports, which in turn can influence the financial predictability and attractiveness of renewable projects.

Investors may also wonder: Is the growth of renewable energy markets sustainable? While global trends point towards a greener future, there remains uncertainty around technology advancements, storage solutions, and infrastructure needs, all of which can affect long-term prospects.

One question that arises is whether NextEra’s ambitious growth targets in renewables might lead to overextension. Balancing rapid expansion with the complexities of integration and operation isn’t easy, and missteps could be costly.

For more insights into the renewable capital markets and ongoing energy transformations, visit CNBC or explore industry trends at Forbes.

Remaining vigilant to these elements can guide potential investors in making savvy decisions about their engagement with NextEra Energy.