- Nvidia’s stock has experienced astronomical growth over the past decade, turning a $100 investment into nearly $25,000.

- The company boasts a market capitalization of $3.4 trillion, making it the second-most valuable company in the world.

- The future looks promising for Nvidia, driven by accelerated computing and an anticipated $1 trillion revenue boost from data center advancements.

- Nvidia dominates the data center GPU market with an 85% share, positioning itself for substantial revenue growth, even amidst competition.

- Cloud gaming presents a significant opportunity, projected to grow from under $5 billion to $237 billion, appealing to gamers seeking cost-effective performance.

- Nvidia’s valuation remains attractive with forward earnings aligned with growth, supported by a potential $2 trillion addressable market.

- Though past growth rates may not recur, Nvidia is well-positioned for future innovation-driven success.

Amid the roar of the stock market, a giant strides forward undeterred. Nvidia, a colossus in the world of graphics cards, has spun an incredible tale over the last decade. A mere $100 investment in its stock back then would now sit at nearly $25,000. Such astonishing growth wasn’t spun from thin air; it was fueled by Nvidia’s deft navigation of burgeoning markets like video gaming, connected cars, and AI.

With a remarkable ascent to become the second-most valuable company globally, Nvidia stands with a market cap of an awe-inspiring $3.4 trillion. Yet, investors, always hungry for the next leap, wonder about the future. Will Nvidia sustain its momentum, or has it scaled its zenith?

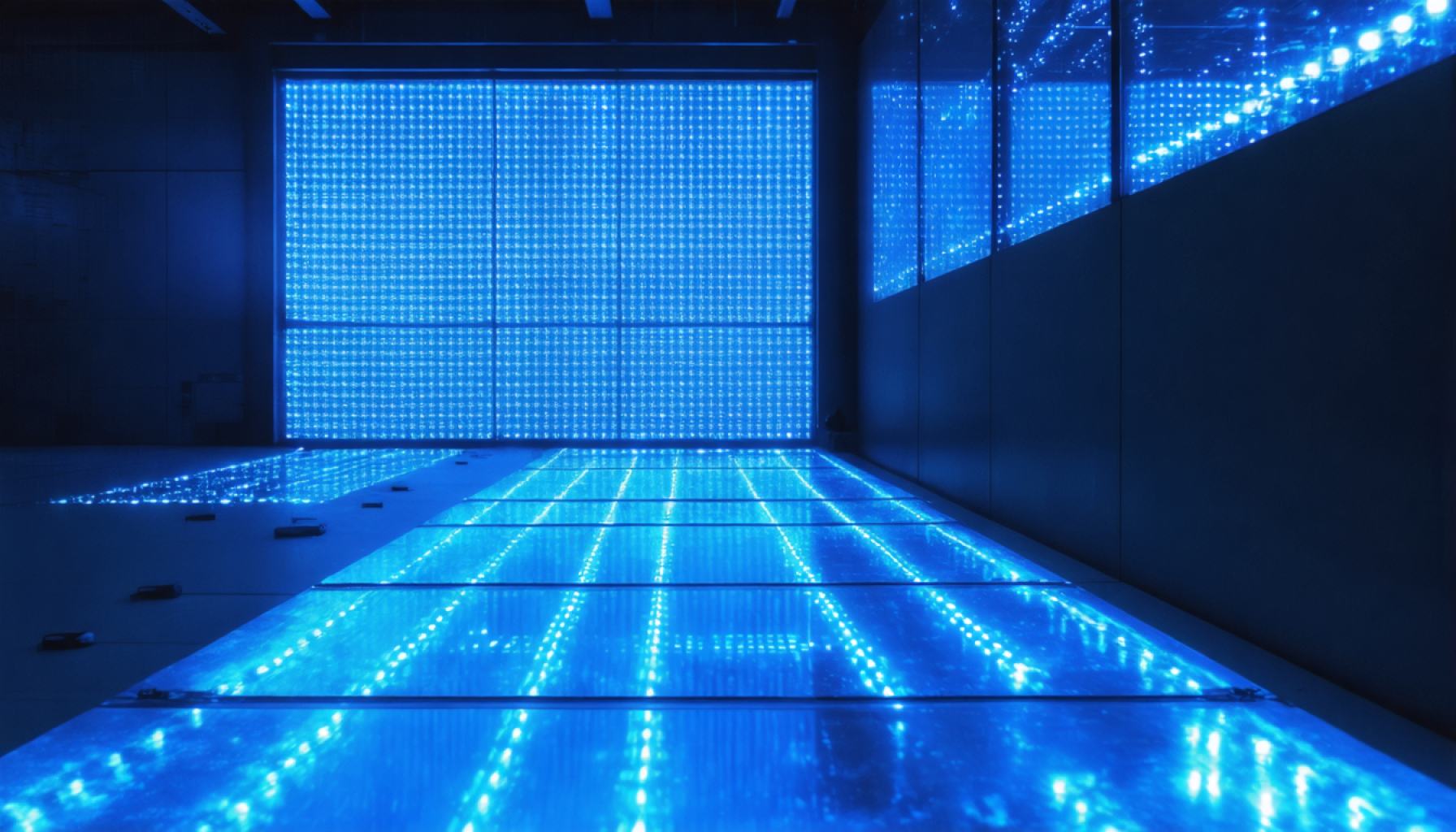

The coming decade presents a distinctive allure for Nvidia, primarily through the advent of accelerated computing. Envision vast data centers humming with the power of graphics processing units (GPUs), enhancing speed and slashing energy consumption. These will become pivotal in tackling today’s data-intensive tasks. Nvidia’s CEO, Jensen Huang, foresees a $1 trillion revenue windfall from these technological shifts.

Such investment might seem extravagant, yet it isn’t inconceivable. Consider that data center construction, accruing to $2.6 trillion between 2017 and 2024, now demands upgrades to cope with AI demands. Nvidia holds a commanding 85% of the data center GPU market, paving the way for substantial upside. Even with increased competition, a firm foothold could translate to a fivefold revenue increase in this sector.

Nvidia also sets its sights on the horizon of cloud gaming, an arena predicted to swell from less than $5 billion to $237 billion. This market caters to gamers hungry for cutting-edge experiences without the burden of expensive hardware, relying instead on swift internet.

While the tech titan’s narrative unfolds at the cusp of evolution, its valuation remains remarkably appealing. Trading at a forward earnings multiple that aligns well with growth expectations, Nvidia, at present, offers a sound proposition. The prospects of a $2 trillion addressable market prop up its credentials as a long-term play.

In sum, while the meteoric rise of yesteryears won’t likely repeat, Nvidia stands poised for transformative journeys. Investors with an eye on the future might find Nvidia a worthy companion on the road ahead—firmly rooted in innovation, yet forever seeking the sky.

Nvidia’s Future: Can It Sustain Its Meteoric Rise?

Navigating Nvidia’s Growth

Nvidia’s staggering growth story, where a $100 investment a decade ago is now worth nearly $25,000, highlights its mastery of emerging markets. This article explores the less-discussed aspects of Nvidia’s journey and forecasts its future, focusing on Nvidia’s prevailing strength and potential to maintain momentum in the tech industry.

Real-World Use Cases and Industry Trends

Data Centers and AI

Nvidia’s GPUs dominate 85% of the data center GPU market, a crucial driver of its revenue. As AI continues to permeate various industries, from healthcare to automotive, Nvidia’s GPUs are integral in processing these massive data workloads. The transformation in data center architecture, requiring upgrades to support AI applications, places Nvidia in a favorable position to capitalize.

Market Forecast: Data center investment coupled with accelerated computing capabilities hints at revenue potential exceeding $1 trillion. This underlines the importance of Nvidia’s leadership in this sector, despite growing competition.

Cloud Gaming: Future of Entertainment

The forecasted growth of cloud gaming from under $5 billion to $237 billion presents a vast opportunity. Nvidia’s cloud gaming service, GeForce NOW, allows gamers to experience AAA titles without owning expensive hardware. This trend could democratize gaming, making high-quality gaming experiences more accessible.

Industry Trend: The expansion of 5G networks will enhance cloud gaming offerings, reducing latency and improving gameplay experiences, leading to broader adoption.

Pros & Cons Overview

Pros:

– Dominant Market Share: Nvidia’s leadership in GPUs for gaming, AI, and data centers ensures revenue growth in burgeoning markets.

– Innovation Hub: Continuous R&D investments keep Nvidia at the technological forefront, fostering innovation in AI and computing.

– Scalability: Strong infrastructure to support future demand.

Cons:

– Intense Competition: Companies like AMD and Intel are vying for a share of the GPU market, which could eat into Nvidia’s margins.

– Valuation Risks: High market cap could make Nvidia susceptible to valuation corrections amid market volatility.

Insights & Predictions

– Sustainability: As energy-efficiency becomes increasingly vital, Nvidia’s advancements in power-efficient GPUs will be pivotal.

– Security: Given the increasing reliance on cloud solutions, Nvidia must continuously innovate in security infrastructures to maintain trust.

Controversies & Limitations

– Supply Chain Challenges: Like other tech giants, Nvidia faces semiconductor shortages which could disrupt its production timelines.

– Regulatory Hurdles: As Nvidia expands, antitrust scrutiny may arise, potentially affecting its strategic acquisitions or market expansions.

Actionable Recommendations

– Stay Informed: Investors should track Nvidia’s advancements in AI and gaming, as these fields offer the most substantial growth potential.

– Diversify: Consider diversifying portfolios to balance potential risks from market competition.

– Monitor Market Trends: Keep abreast of 5G developments and their impact on cloud gaming.

Nvidia indeed has crafted an impressive narrative over the years. By keeping an eye on industry shifts and leveraging its technological prowess, Nvidia remains poised for continued success. Investors and tech enthusiasts should watch Nvidia as it navigates its transformative journey.

For more insights into the tech world, explore the resources at nvidia.com.